Polk County Angel Tree

Published 3:15 pm Wednesday, December 5, 2012

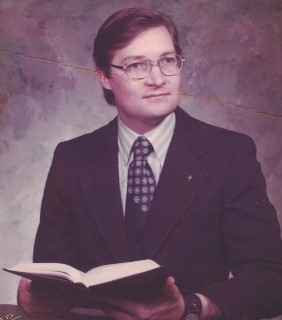

Ambrose and Jean Mills deliver their Angel Tree gifts to Outreach’s Santa workshop at the 4H Youth Center in Columbus. Like many contributors, they are Angels to more than one child. (photos by Joe Epley)

Polk County collected 96.67 percent of its property taxes during fiscal year 2011-2012 compared to collecting 96.66 percent during fiscal year 2010-2011, according to the audit report. Broom said the state likes for local governments to collect at least 95 percent of its property taxes. Similar counties to Polk County collected an average of slightly over 94 percent of property taxes, Broom said.

Broom also said the auditors separately audited the county’s tax office, emergency medical services, the register of deeds and department of social services in order to ensure there were no red flags.

“The records were well organized and there is good processes and controls in place,” Broom said.

Trending

Broom also said that his office interviewed a lot of county employees and visited a lot of departments and found the employees to be very professional, helpful and knowledgeable.

The audit report also notes that Polk’s property tax revenue increased approximately 2.65 percent during fiscal year ending June 30, 2012 due to a slight increase in property valuations with the same trend expected this year.

Polk’s new fiscal year (2012-2013) began July 1.